Evaluate the ROI of a CRM implementation with our online calculator

Return on investment (ROI) is not a difficult concept to understand in its most basic form. When you invest money into something, you want to get back what you invested and hopefully make money off of it too.

But for many calculating the ROI of a CRM implementation can be a frustrating exercise. In order to reduce this frustration, Workbooks has created an ROI calculator that lets you explore for yourself at a high level, some of the financial benefits you can expect from implementing CRM, providing you with a starting point to focus the minds and drive expectations.

Introducing the ROI Calculator

We originally created the ROI calculator as a spreadsheet model after customers reached out to us for help in obtaining final sign-off for their CRM initiative. After the spreadsheet became popular we decided to create an interactive online version, which has the benefit of being faster and more user-friendly. Yes it is high level and we would encourage you to still dig deeper into the details but it is a good tool to start putting some initial numbers behind the initiative.

The ROI calculator works by scoring yourself out of ten on three criteria, which is used to compute against your total sales to provide a projected financial benefit of a CRM implementation. The financial figure is broken down across new business, existing business and sales management whilst also showing the full workings behind the calculation.

Interested in running the numbers? Press the button below:

How to use the calculator:

Step 1. Score yourself out of 10 on generating new business

Negative indicators include not being able to track leads once passed to the sales team & a lack of transparency around Marketing ROI. Positive indicators include being able to rapidly build targeted Marketing campaigns and reviewing individual performance on lead follow up.

Step 2. Score yourself at cross-selling to your existing customers and retaining business

Negative indicators include lacking a central database of all customer interaction, not knowing who to target with new products or which customers are unhappy. Positive indicators include easily targeting customers based on prior purchases, customer size, interest & industry etc.

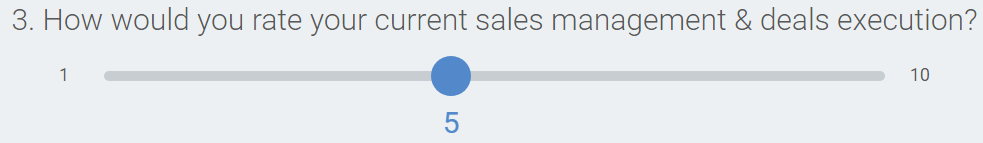

Step 3. Rate your current sales management & deals execution out of 10

Negative indicators include teams being burdened by admin tasks, missing sales forecasts and losing deals unexpectedly. Positive indicators include being able to easily create accurate sales forecasts, having a proven sales methodology, which everyone follows, and knowing why deals are lost or won.

Step 4. Enter your expected total sales

Step 4. Enter your expected total sales

Step 5. Enter your details (your report will be emailed) and hit ‘Get Results’