- Welcome to the Knowledge Base

- Introduction

- Training

- Getting Started

- Preferences

- Activities

- Cases

- Forecasts & Quotas

- Importing Data

- Leads

-

Marketing

- Introduction to Marketing

- Marketing Campaigns

- Mailing Lists

- Products

- Mailshots

- Upload Library

- Templates

- Event Management

- Compliance Records

-

Spotler Integration

- What is Spotler?

- Navigating your Spotler homepage

- GatorMail

-

GatorLeads / Web Insights

- Tracking Code

- Setting up the Plugin

- Viewing Web Insights Data on your Form Layouts

- Domain Names and Online Activities

- Reporting incorrect Leads created through Web Insights

- Reporting on Web Insights data

- Using UTM Values

- Why aren’t Online Activities being created in the database?

- Why is GatorLeads recording online activities in a foreign language?

- GatorSurvey

- GatorWorkflow

- GatorPopup

- Opportunities

-

Integrations

- Mapping

- Electronic Signing Tools

- Creditsafe Integration

-

Zapier

- Introduction to Zapier

- Available Triggers and Actions

- Linking your Workbooks Account to Zapier

-

Setting up Zaps

- Posted Invoices to Xero Invoices

- Xero payments to Workbooks Tasks

- New Case to Google Drive folder

- New Case to Basecamp Project

- New Workbooks Case to JIRA Ticket

- Jira Issue to new Case

- 123FormBuilder Form Entry to Case

- Eventbrite Attendee to Sales Lead and Task

- Facebook Ad Leads to Sales Leads

- Wufoo Form Entry to Sales Lead

- Posted Credit Note to Task

- QuickBooks Online

- Survey Monkey responses to Tasks

- Multistep Zaps

-

Email Integrations

- Email Dropbox

- Workbooks Exchange Server Sync

- Workbooks Outlook Connector

- RevenueGrid Intelligence and Engage

-

Event & Webinar Integration Tools

- GoToWebinar

- ON24

- Microsoft Office

-

Outreach

- Installation

- Outreach Authentication

- Sync People to Outreach Prospects

- Sync Organisations to Outreach Accounts

- Sync Workbooks Opportunities to Outreach

- Sync Tasks/Activities from Workbooks to Outreach

- Sync Outreach Sequences to Workbooks

- Sync Outreach Sequence States to Workbooks

- Sync Outreach Sequence Step Numbers to Workbooks

- Sync Prospects/Accounts/Opportunities from Outreach to Workbooks

- Sync Outreach Tasks/Calls/Meetings to Workbooks

- Scribe/Workbooks Connector

- RingCentral

- Auditing

- Comments

- People & Organisations

- Projects

-

Reporting

- Introduction to Reporting

- Using Reports

- Charts

- Exporting Reports

- Advanced Reporting

- Report Snapshots

- Dashboards

-

Transaction Documents

-

Introduction to Transaction Documents

- Displaying & Adding Transaction Documents

- Copying Transaction Documents

- Transaction Documents Fields Help

- Transaction Documents Line Items Help

- Printing & Sending Transaction Documents

- Managing Transaction Document Currencies

- Managing Transaction Document Statuses

- Setting a Blank Default Currency on Transaction Documents

- Credit Notes

- Customer Orders

- Invoices

- Quotations

- Supplier Orders

- Contract Management

- Sagelink

-

Introduction to Transaction Documents

- Auditing

-

Configuration

- Introduction to System Administration

- Users & Security

- Preferences

- Database

- Accounting

- Email & Integration

-

Customisation

- Creating & Modifying Picklists

- Theme

-

Record Types

- Creating Custom Fields

- Report-based Custom Fields

- Linked Fields & Reference Fields

- Record Templates

- Form Layouts

- Customising relationships between parties

- Opportunity Stages

- Custom Records

- Automation

- PDF Configuration

- Contact Support

- Releases & Roadmap

Using Sales Tax Rulesets

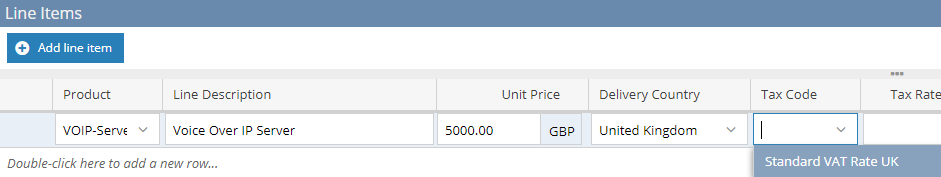

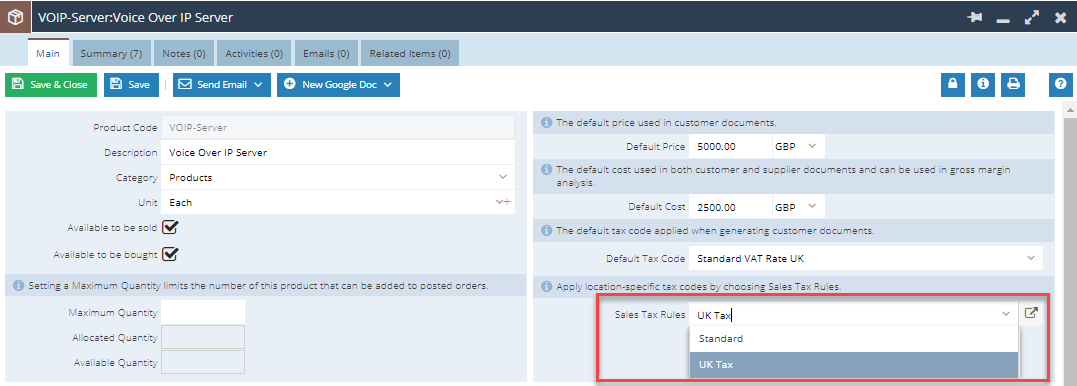

To save you time when creating Transaction Documents and if a Product is sold repeatedly to the same customer you can configure specific Rulesets on Products.

Within the Picklist Sales Tax Rules on the Product you will be able to choose from all available Sales Tax Rulesets across all Tax Regimes.

Note: If you are unsure if you have selected the correct ruleset you can use the open URL button on the field to immediately open the record and check that this is the correct one.

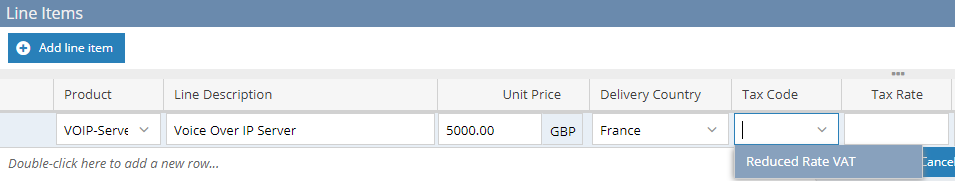

Once set on the Product, you will then be able to restrict Tax Codes on the Line Items based on the Customer Country and / or the Delivery Country that is set on the Line Item.

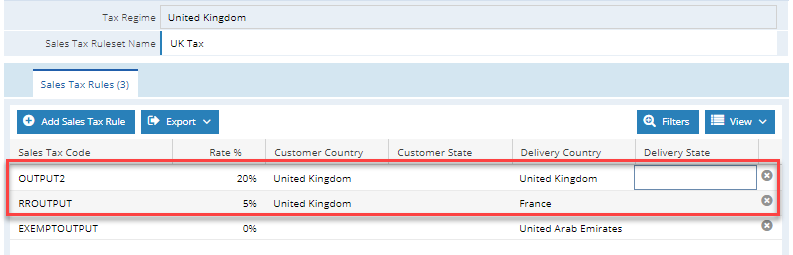

In the example below, we have created a Tax Ruleset where the Customer Country is set to be the United Kingdom and the Delivery Country is set to France or United Kingdom.

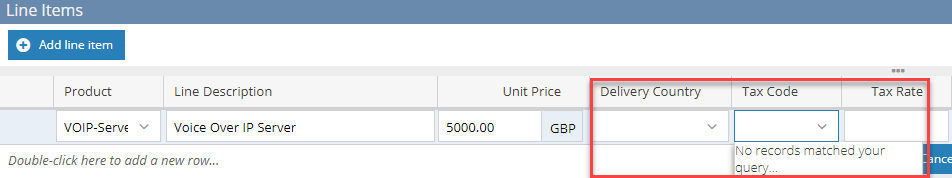

When creating a Line Item using a Product with this Ruleset applied and the Customer has a Country of United Kingdom, but a Delivery Country is not set, then no Tax Codes are available.

However, upon changing the Delivery Country to France or United Kingdom, the respective Tax Code becomes available.

These Rulesets can then be used to ensure that users are always setting the correct rates with the information provided.