Knowledgebase articles

- Welcome to the Knowledge Base

- Introduction

- Welcome to Workbooks Support: Your Go-To Guide

- Getting Started

- Preferences

- Activities

- Cases

- Introduction to Cases

- Displaying & Adding Cases

- Managing Cases

- Using the Case Portal

- Email

- Importing Data

- Leads

- Marketing

- Introduction to Marketing

- Mailshots

- Templates

- Event Management

- Compliance Records

- Spotler Integration

- What is Spotler?

- Navigating your Spotler homepage

- Introduction to GatorMail

- GatorMail Configuration

- GatorMail Hard Bounces

- Sending Emails in GatorMail

- Advanced Features

- GatorCreator

- Setting up the Plugin

- Viewing Web Insights Data on your Form Layouts

- Domain Names and Online Activities

- Reporting incorrect Leads created through Web Insights

- Reporting on Web Insights data

- Using UTM Values

- Why aren’t Online Activities being created in the database?

- Why is GatorLeads recording online activities in a foreign language?

- GatorSurvey

- GatorPopup

- DotDigital

- Integrations

- SFTP/FTP Processes

- Docusign Integration

- DocuSign Functionality

- Adobe Sign Integration

- Zapier

- Introduction to Zapier

- Available Triggers and Actions

- Linking your Workbooks Account to Zapier

- Posted Invoices to Xero Invoices

- Xero payments to Workbooks Tasks

- New Case to Google Drive folder

- New Case to Basecamp Project

- New Workbooks Case to JIRA Ticket

- Jira Issue to new Case

- 123FormBuilder Form Entry to Case

- Eventbrite Attendee to Sales Lead and Task

- Facebook Ad Leads to Sales Leads

- Wufoo Form Entry to Sales Lead

- Posted Credit Note to Task

- Survey Monkey responses to Tasks

- Multistep Zaps

- Email Integrations

- Microsoft Office

- Auditing

- Comments

- People & Organisations

- Introduction to People & Organisations

- Using Postcode Lookup

- Data Enrichment

- Reporting

- Transaction Documents

- Displaying & Adding Transaction Documents

- Copying Transaction Documents

- Transaction Documents Fields Help

- Transaction Documents Line Items Help

- Printing & Sending Transaction Documents

- Managing Transaction Document Currencies

- Managing Transaction Document Statuses

- Setting a Blank Default Currency on Transaction Documents

- Credit Notes

- Customer Orders

- Invoices

- Quotations

- Supplier Orders

- Sagelink

- Configuration

- Releases & Roadmap

- Workbooks Glossary

QuickBooks Sales Tax Code Lookup

This integration will be available by the end of March 2020

On the Product Record, the Plugin creates a field called “QuickBooks Sales Tax Lookup” which is an iFrame Custom Field. When clicked it provides the user with a list of QuickBooks Sales Tax Codes that can be set on the Product record in Workbooks.

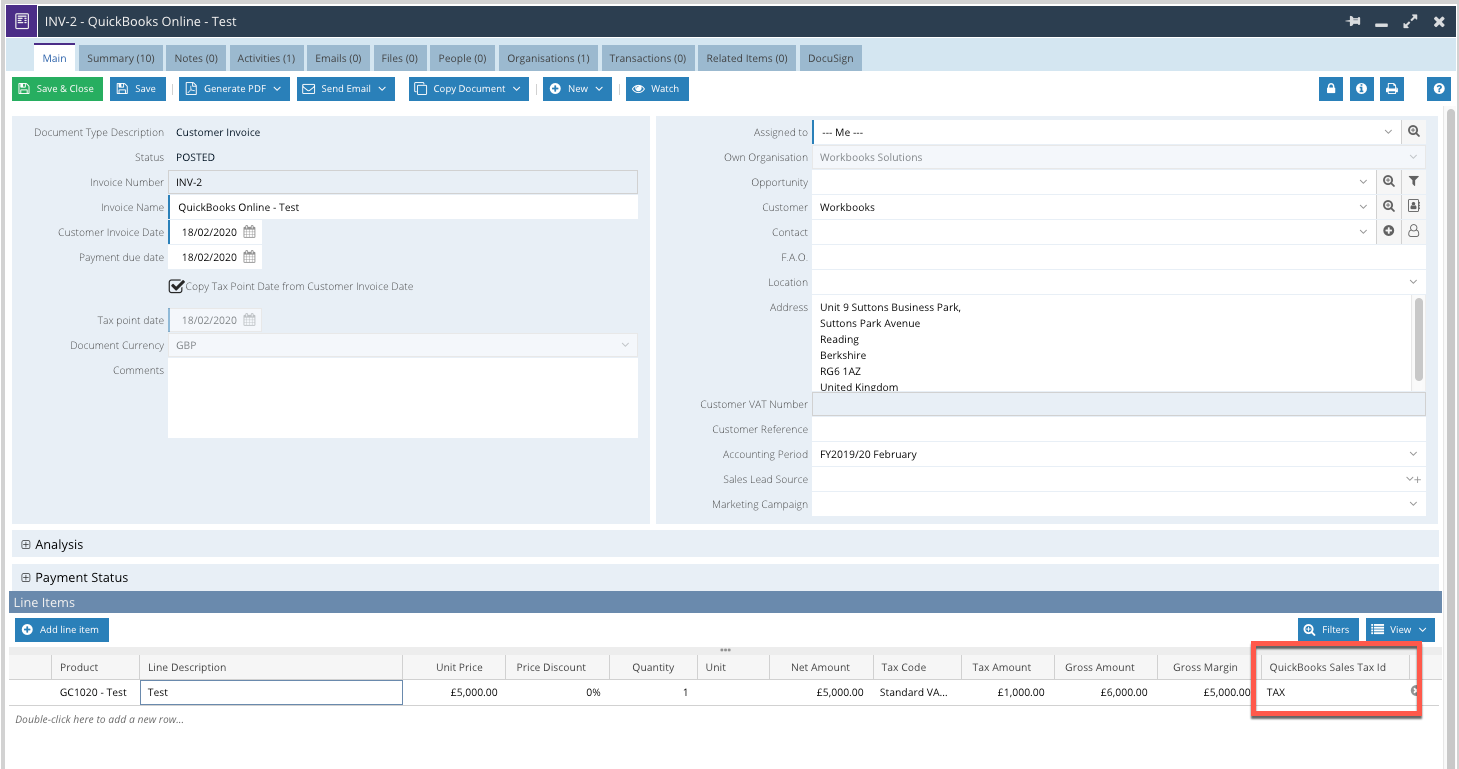

If set, that Sales Tax Code will pull through to any Transaction Document Line Item where that Product is used and then in turn will sync to QuickBooks Online when a new Invoice is POSTED.

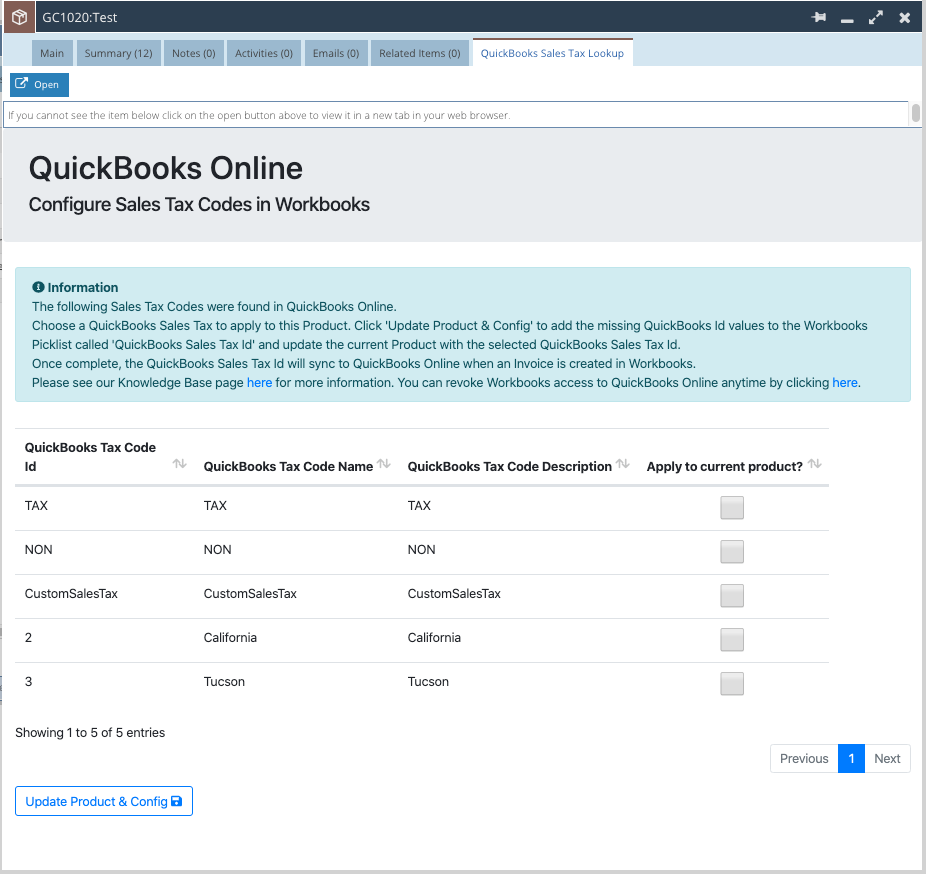

From a Product record, click the “QuickBooks Sales Tax Lookup” tab.

- If this is the first time you have used the integration, or it has been at least 100 days since the last time you used this tab, you will be asked to authenticate with QuickBooks which will allow Workbooks to connect to your QuickBooks account on your behalf.

- If you have used this tab before, the list of QuickBooks Sales Tax Codes will display on the screen. Simply select which QuickBooks Tax Code you wish to apply to the current Workbooks Product record by clicking the checkbox in the Apply to Current Product column. Once you have made a selection, apply the change to Workbooks by clicking Update Product & Config.

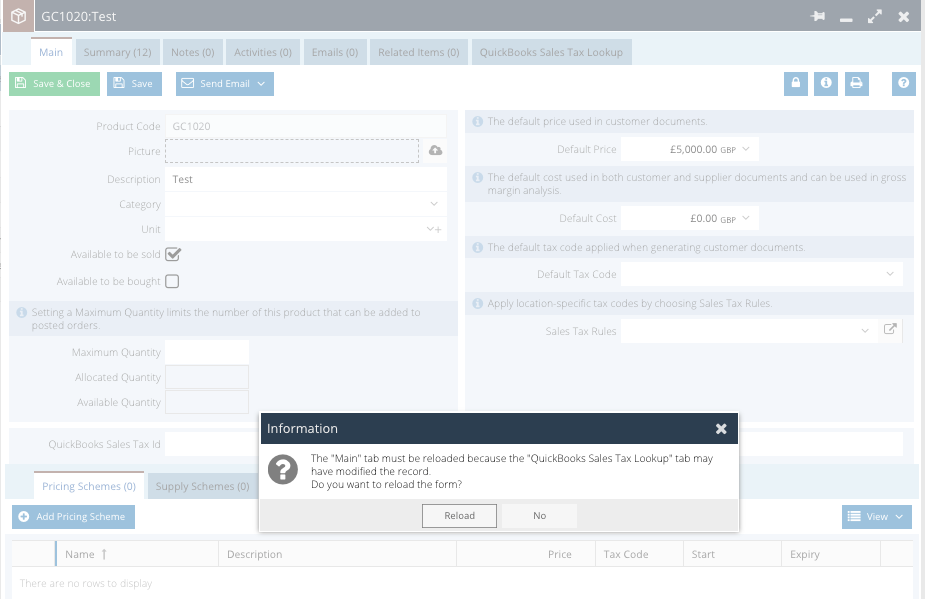

Go back on the Main tab of the Product record, and when prompted click “Reload” in the dialogue box:

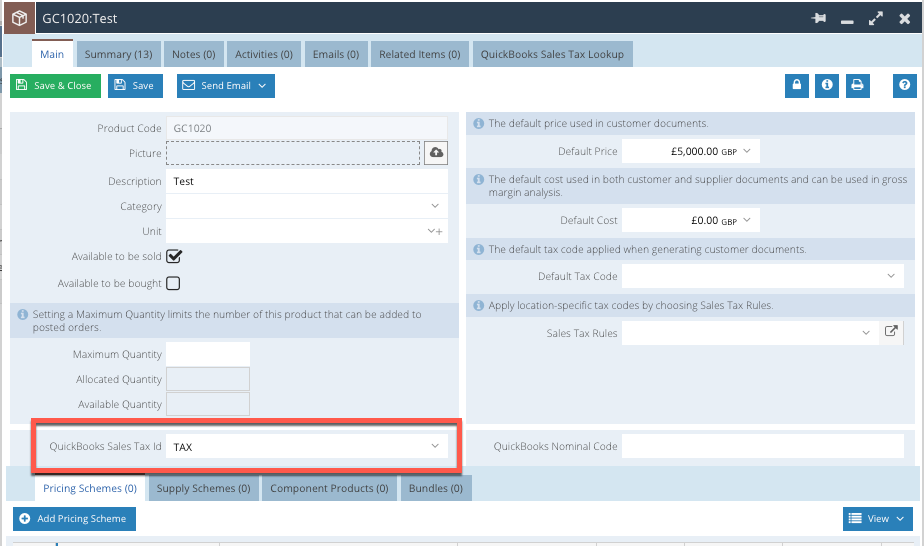

Notice that the selected QuickBooks Sales Tax Code has been updated on the Product in the field called “QuickBooks Sales Tax Id”:

The next time you use this Product on any Transaction Document, the QuickBooks Sales Tax Id will automatically be set on any Line Items.

NOTE: If you have used this Product prior to setting the QuickBooks Sales Tax Id, the value on these Line Items will be unaffected.