Knowledgebase articles

- Welcome to the Knowledge Base

- Training

- Introduction

- Welcome to Workbooks Support: Your Go-To Guide

- Getting Started

- Preferences

- Activities

- Cases

- Introduction to Cases

- Displaying & Adding Cases

- Managing Cases

- Using the Case Portal

- Email

- Importing Data

- Leads

- Marketing

- Introduction to Marketing

- Mailshots

- Templates

- Event Management

- Compliance Records

- Spotler Integration

- What is Spotler?

- Navigating your Spotler homepage

- Introduction to GatorMail

- GatorMail Configuration

- GatorMail Hard Bounces

- Sending Emails in GatorMail

- Advanced Features

- GatorCreator

- Setting up the Plugin

- Viewing Web Insights Data on your Form Layouts

- Domain Names and Online Activities

- Reporting incorrect Leads created through Web Insights

- Reporting on Web Insights data

- Using UTM Values

- Why aren’t Online Activities being created in the database?

- Why is GatorLeads recording online activities in a foreign language?

- GatorSurvey

- GatorPopup

- DotDigital

- Integrations

- SFTP/FTP Processes

- Docusign Integration

- DocuSign Functionality

- Adobe Sign Integration

- Zapier

- Introduction to Zapier

- Available Triggers and Actions

- Linking your Workbooks Account to Zapier

- Posted Invoices to Xero Invoices

- Xero payments to Workbooks Tasks

- New Case to Google Drive folder

- New Case to Basecamp Project

- New Workbooks Case to JIRA Ticket

- Jira Issue to new Case

- 123FormBuilder Form Entry to Case

- Eventbrite Attendee to Sales Lead and Task

- Facebook Ad Leads to Sales Leads

- Wufoo Form Entry to Sales Lead

- Posted Credit Note to Task

- Survey Monkey responses to Tasks

- Multistep Zaps

- Email Integrations

- Microsoft Office

- Auditing

- Comments

- People & Organisations

- Introduction to People & Organisations

- Using Postcode Lookup

- Data Enrichment

- Reporting

- Transaction Documents

- Displaying & Adding Transaction Documents

- Copying Transaction Documents

- Transaction Documents Fields Help

- Transaction Documents Line Items Help

- Printing & Sending Transaction Documents

- Managing Transaction Document Currencies

- Managing Transaction Document Statuses

- Setting a Blank Default Currency on Transaction Documents

- Credit Notes

- Customer Orders

- Invoices

- Quotations

- Supplier Orders

- Sagelink

- Configuration

- Releases & Roadmap

- Workbooks Glossary

Setting Tax Rates

How to set up Tax Rates within Workbooks and how to amend them if they have changed.

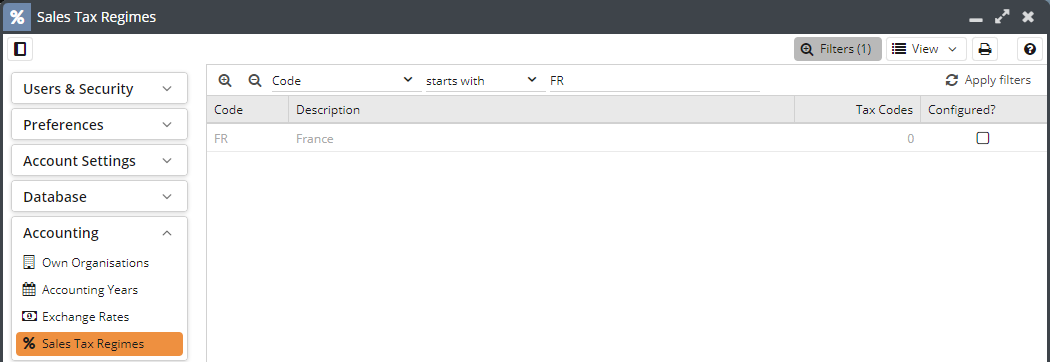

To set up a new Sales Tax Code you will first need to select the appropriate regime, you should be able to identify these by searching through either the Tax Code or the Description.

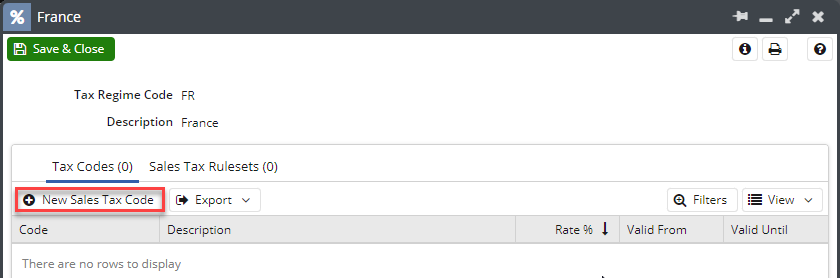

When you open an unconfigured Tax Regime you will see a window similar to the below where the Tax Code box at the bottom of the page is empty.

Selecting the New Sales Tax Code button will create a new window allowing you to start configuring a new tax code.

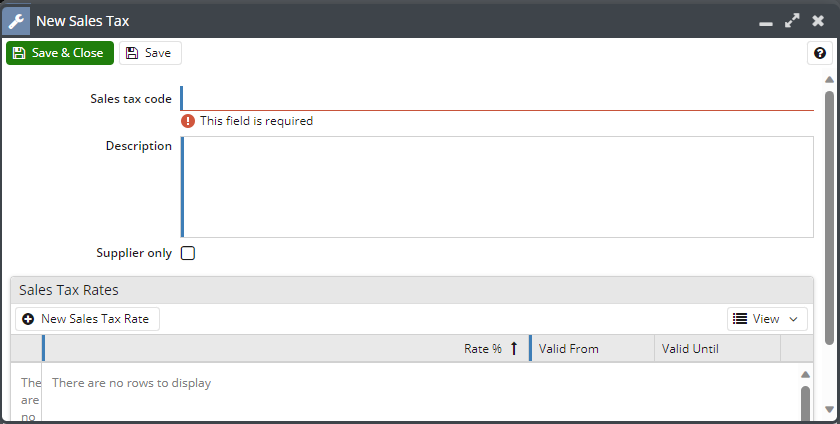

Here you will need to fill out the following information:

Sales tax code: The code you will be using internally to define the Tax Code such as “EXEMPT” or “STANDARDVAT”

Description: A short description of the

Supplier only: Check this box if the tax code will only be used within Supplier Orders, otherwise this will appear on all Transaction Documents.

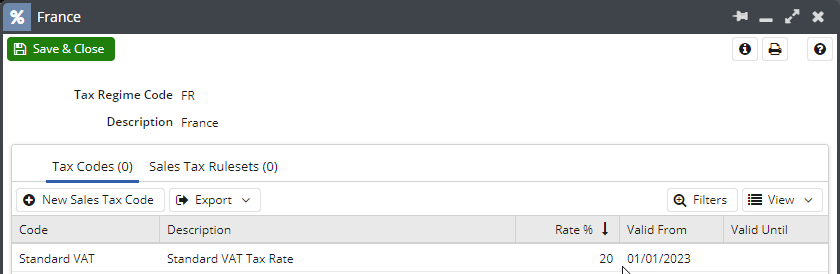

Once this has been completed you can start adding in the tax rates by using New Sales Tax Rates

Rate %: Set the Tax rate that this will be charged at.

Valid From: Set when you want to start charging this rate from, this will affect any Transaction Document if the Document Date is changed and is after the Valid From date.

Valid Until: If the tax rate changes you can expire this rate by setting the Valid Until date and then creating a new Sales Tax Rate.

Note: Sales Tax Codes and Sales Tax Rates cannot be deleted once created.