Knowledgebase articles

- Welcome to the Knowledge Base

- Introduction

- Workbooks Support: Your Go-To Guide

- Getting Started

- Preferences

- Activities

- Cases

- Introduction to Cases

- Displaying & Adding Cases

- Managing Cases

- Using the Case Portal

- Email

- Importing Data

- Leads

- Marketing

- Introduction to Marketing

- Event Management

- Compliance Records

- Spotler Integration

- What is Spotler?

- Navigating your Spotler homepage

- Introduction to GatorMail

- GatorMail Configuration

- Sending Emails in GatorMail

- Advanced Features

- Setting up the Plugin

- Viewing Web Insights Data on your Form Layouts

- Domain Names and Online Activities

- Reporting incorrect Leads created through Web Insights

- Reporting on Web Insights data

- Using UTM Values

- Why aren’t Online Activities being created in the database?

- Why is GatorLeads recording online activities in a foreign language?

- GatorSurvey

- GatorPopup

- Integrations

- SFTP/FTP Processes

- Docusign Integration

- DocuSign Functionality

- Adobe Sign Integration

- Zapier

- Introduction to Zapier

- Available Triggers and Actions

- Linking your Workbooks Account to Zapier

- Posted Invoices to Xero Invoices

- Xero payments to Workbooks Tasks

- New Case to Google Drive folder

- New Case to Basecamp Project

- New Workbooks Case to JIRA Ticket

- Jira Issue to new Case

- 123FormBuilder Form Entry to Case

- Eventbrite Attendee to Sales Lead and Task

- Facebook Ad Leads to Sales Leads

- Wufoo Form Entry to Sales Lead

- Posted Credit Note to Task

- Survey Monkey responses to Tasks

- Multistep Zaps

- Email Integrations

- Microsoft Office

- Auditing

- Comments

- People & Organisations

- Introduction to People & Organisations

- Using Postcode Lookup

- Data Enrichment

- Reporting

- Transaction Documents

- Displaying & Adding Transaction Documents

- Copying Transaction Documents

- Transaction Documents Fields Help

- Transaction Documents Line Items Help

- Printing & Sending Transaction Documents

- Managing Transaction Document Currencies

- Managing Transaction Document Statuses

- Setting a Blank Default Currency on Transaction Documents

- Credit Notes

- Customer Orders

- Invoices

- Quotations

- Supplier Orders

- Sagelink

- Configuration

- Releases & Roadmap

Setting up your Email Server

How to set up your Email Server to work from within Workbooks.

STEP ONE : Establish the details of your SMTP email server

If you have your own in-house email system, then your IT staff should be able to provide you with the hostname or IP address of your server. If you use a hosted email server, then your service provider can supply you with these details.

STEP TWO: Create a new user on your SMTP email server, which can be used to authenticate against

Nearly all SMTP servers will block unauthenticated connections; therefore you need to create a user name and password on your email server, so that Workbooks can use the credentials to authenticate.

STEP THREE: Allow the Workbooks Servers access to your SMTP server (If you use an in-house email server)

If you use an in-house server, it is likely that your firewall will block SMTP connections from Workbooks. Therefore, your firewall needs to be changed to allow the servers access.

You need to allow access from three IP ranges on port 25.

Range One: 80.69.20.160/28 (i.e. the addresses 80.69.20.161 through 80.69.20.174).

Range Two: 89.187.105.224/28 (i.e. the addresses 89.187.105.225 through 89.187.105.238).

Range Three: 167.98.21.80/28 (i.e. the addresses 167.98.21.81 through 167.98.21.94).

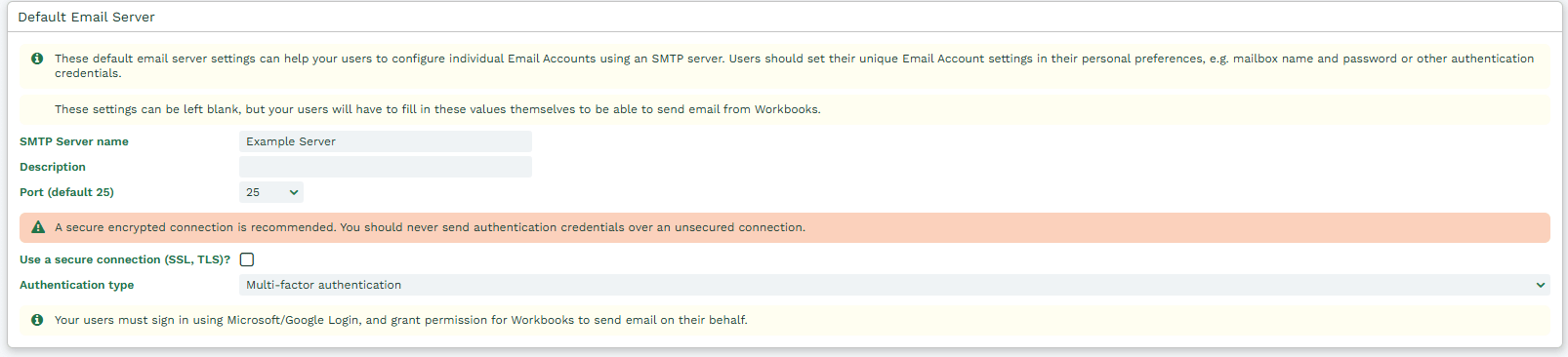

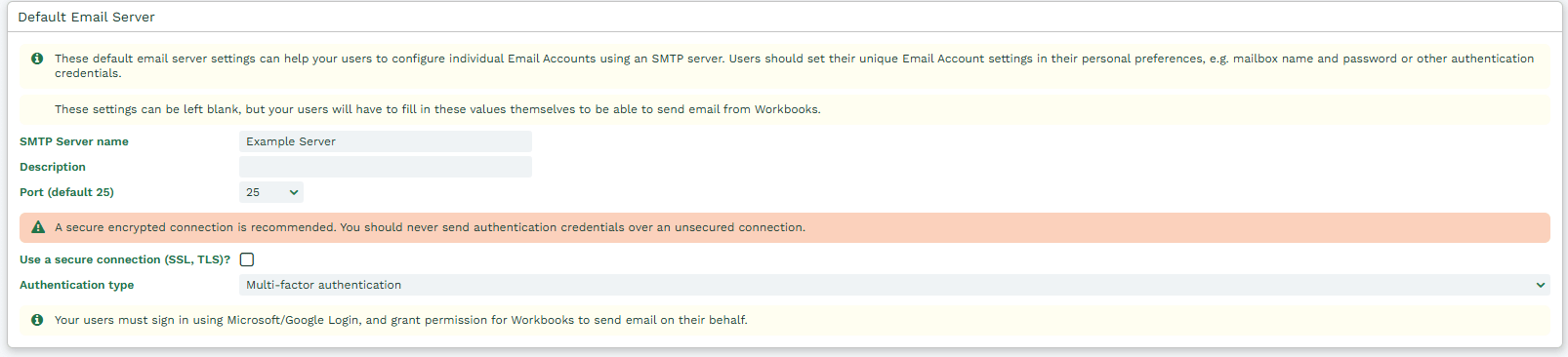

STEP FOUR: Add the details of your SMTP server and the user name and password you created to Workbooks

Click Start > Configuration > Email & Integration > Email Settings.

Enter the hostname (or IP address) of your SMTP server in the SMTP Server name field. If you have multiple SMTP servers then you will enter a hostname here which resolves to more than one IP address in DNS.

In the Description field simply add text to document the SMTP server being used.

Select the port number, this is very likely to be port 25, unless your SMTP server has an unusual configuration.

Remember to click Save.